Author Archives: EC Mortgage Lenders

Staging Your Home to Sell During the Hol...

It’s that time of year again, folks, and if your home is on the market, you might be wondering if it’s worth it to string up a few lights before showcasing your home to potential buyers. In short, the answer is a resounding: yes! Few things speak louder to a home’s potential than the ability […]

Mortgage Rate Outlook – December 2...

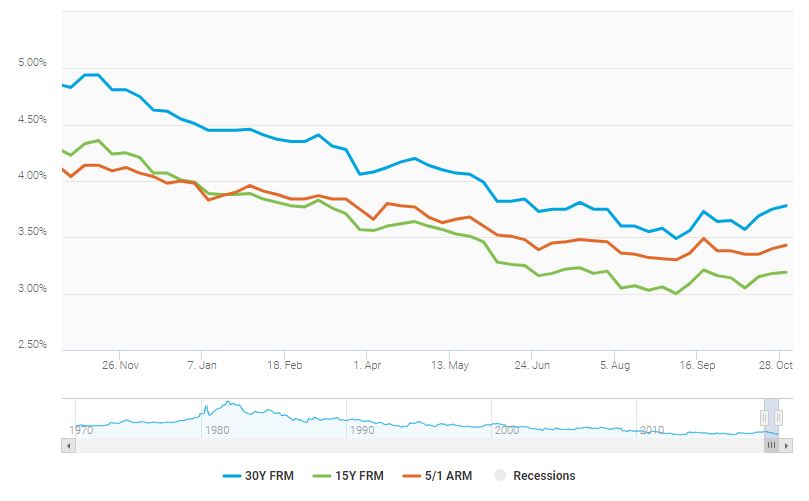

Rates for 2019 have been low since the spring and show no sign of increasing dramatically in the coming months. As of December 2nd, rates are hovering at about 3.7%, which is actually the expected average of rates in 2020. Good news, right? Absolutely! That being said, 3.7% is the expected average for 2020. There’s […]

Common Real Estate Scams – and How...

When you’re buying or selling a home, you have to be on your guard for some of the most common (but not necessarily easy to recognize) real-estate-related scams that are out there. Spoofing/Email Fraud One of the simplest involves mimicking your email and stealing downpayment, good faith escrow or other payment. To avoid this scam, […]

Alert: Mortgage Rates Rising...

According to Freddie Mac, mortgage rates are rising, and have been for three straight weeks. What does this mean for potential homebuyers? Time to Lock it In? Is it time to lock in your mortgage rates? We think so. With the rates on the rise, the sooner you lock in your rate, the better. Locking […]

Homeselling Tips for the Fall – Th...

Are you considering selling your home? Selling in the fall can be difficult, as folks are settling in for the Holiday Season and winter time. When you’re in the throes of homesales, it’s important to remember the small details that stand out in people’s minds. Check out the video above for some useful tips in […]

Boo! Setting a spooky style for your Tri...

Are you looking to spice up your home this Halloween? Perhaps…pumpkin-spice it up? Here are a few tips to make your trick-or-treaters gasp with delight. Ambiance Setting the mood is all about lighting and sound. Set some speakers up with organ music or spooky haunted house noises. The sound will permeate the front walk and […]

Simple tips for organization…does ...

If you’re a Marie Kondo fan, you may have seen her TV show. As organizational tips go, hers are some of the more simple. De-clutter, remove items that you truly don’t need, and don’t “spark joy.” So what does that mean for you exactly? It’s fairly simple. Look around at your environment. Does every item […]